Featured

Table of Contents

If you have inquiries or want even more info regarding AMP, please visit our Help Center. Image Are enlisted in the California Alternative Rates for Energy (TREATMENT) or Household Electric Price Aid (FERA) program. Have actually been an SCE consumer for at the very least 6 months. Have a past-due costs amounting to even more than $500 (several of which have actually been overdue for even more than 90 days). Have made at the very least one on-time settlement in the previous 24 months.

Consumers that register in the AMP program are not qualified for installation strategies. Internet Power Metering (NEM), Straight Access (DA), and master metered consumers are not presently eligible. For consumers intending on relocating within the next 60 days, please put on AMP after you have actually developed solution at your brand-new move-in address.

The catch is that not-for-profit Debt Card Debt Forgiveness isn't for every person. InCharge Financial debt Solutions is one of them.

"The various other emphasize was the attitude of the counselor that we might obtain this done. I was feeling like it had not been mosting likely to occur, however she maintained with me, and we got it done." The Credit Score Card Mercy Program is for individuals who are thus far behind on charge card payments that they remain in serious financial difficulty, possibly encountering insolvency, and don't have the earnings to catch up."The program is particularly created to assist clients whose accounts have actually been charged off," Mostafa Imakhchachen, customer treatment expert at InCharge Debt Solutions, claimed.

An Unbiased View of "Specialty Counseling Services : APFSC Tailored Financial Support Is Shameful" Debunked

Lenders that get involved have agreed with the nonprofit credit score therapy company to accept 50%-60% of what is owed in dealt with regular monthly settlements over 36 months. The set repayments mean you know specifically just how much you'll pay over the payment duration. No rate of interest is charged on the equilibriums throughout the payback duration, so the settlements and amount owed do not alter.

But it does reveal you're taking an active role in decreasing your debt. Because your account was already means behind and billed off, your credit score was already taking a hit. After settlement, the account will be reported as paid with an absolutely no equilibrium, instead of outstanding with a collections firm.

The agency will pull a credit history report to understand what you owe and the extent of your difficulty. If the mercy program is the finest solution, the therapist will certainly send you a contract that details the plan, including the quantity of the monthly payment.

As soon as everybody agrees, you start making regular monthly settlements on a 36-month strategy. When it mores than, the agreed-to quantity is eliminated. There's no fine for settling the equilibrium early, but no extensions are allowed. If you miss out on a settlement, the agreement is nullified, and you have to leave the program. If you think it's a great option for you, call a therapist at a nonprofit credit history therapy company like InCharge Financial obligation Solutions, that can answer your concerns and help you figure out if you qualify.

Get This Report about How Specialty Counseling Services : APFSC Tailored Financial Support Preserves What You've Earned

Due to the fact that the program permits consumers to go for much less than what they owe, the lenders that take part want peace of mind that those who make use of it would certainly not be able to pay the sum total. Your charge card accounts additionally need to be from financial institutions and debt card business that have actually agreed to get involved.

If you miss out on a repayment that's just one missed payment the arrangement is ended. Your lender(s) will certainly terminate the strategy and your balance goes back to the original amount, minus what you have actually paid while in the program.

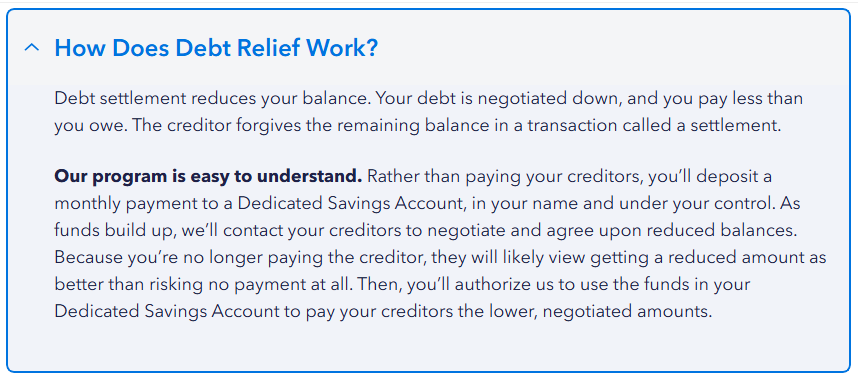

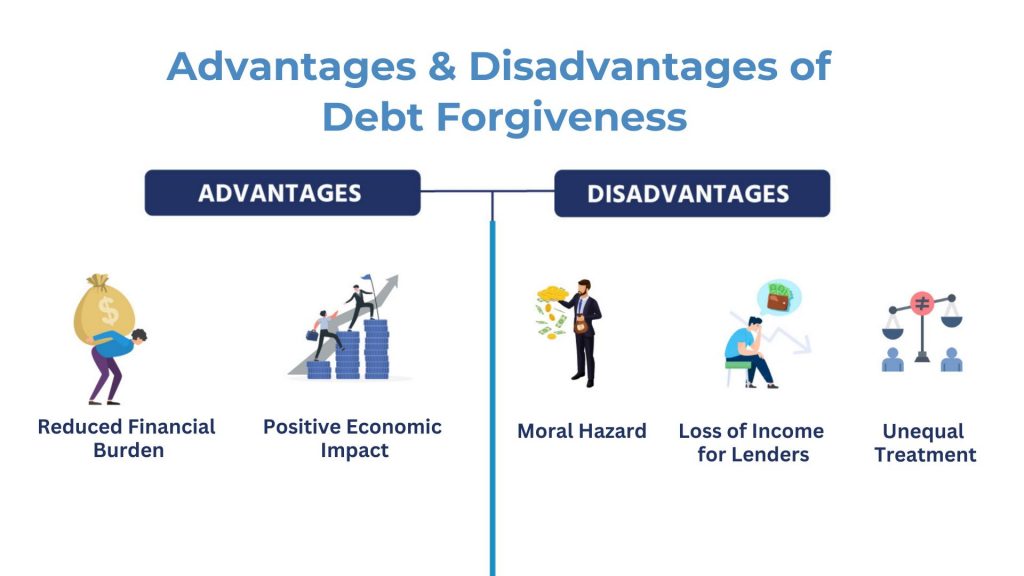

With the forgiveness program, the lender can instead choose to maintain your financial obligation on the publications and redeem 50%-60% of what they are owed. Nonprofit Credit Scores Card Financial debt Forgiveness and for-profit financial obligation negotiation are similar because they both offer a means to settle charge card financial debt by paying much less than what is owed.

The Best Guide To What to Watch For When Researching Forgiveness Services

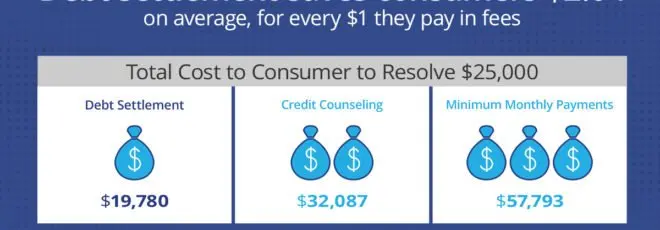

Bank card mercy is developed to set you back the customer much less, pay off the financial debt quicker, and have less downsides than its for-profit equivalent. Some vital areas of distinction between Bank card Debt Forgiveness and for-profit debt negotiation are: Debt Card Financial obligation Forgiveness programs have partnerships with financial institutions who have actually accepted get involved.

Once they do, the payback duration starts instantly. For-profit financial debt settlement programs discuss with each creditor, typically over a 2-3-year period, while interest, costs and calls from financial obligation collection agencies continue. This implies a larger appeal your debt report and credit report, and an enhancing equilibrium till settlement is completed.

Credit Report Card Financial debt Mercy clients make 36 equal month-to-month settlements to remove their financial debt. For-profit financial debt settlement clients pay into an escrow account over an arrangement duration toward a lump sum that will be paid to lenders.

Table of Contents

Latest Posts

Little Known Questions About Everything to Understand Throughout the Sustainable Finance for Households: Integrating ESG Thinking into Personal Budgeting Experience.

What Does Ways Debt Relief Preserves What You've Worked For Mean?

Some Of Why Avoiding Your Debt Problems Can Cost You

More

Latest Posts

What Does Ways Debt Relief Preserves What You've Worked For Mean?

Some Of Why Avoiding Your Debt Problems Can Cost You